How a customer-led approach can lead to realistic business planning.

Picture the scene: Dragon’s Den. The five dragon investors sit imposingly in their leather chairs. To their left each has a bundle of money displayed on a table. An outwardly confident young man stands in front of them, the pitch for his new product rehearsed by heart. He begins and sixty seconds in, the dragons are nodding their heads, impressed and noting some finer points. It’s looking good. He continues “…….the global market size for our software is €850m and is projected to grow by 7% per annum. By capturing just 2% of this market in the next three years we project revenues of €18m.” It’s an impressive number but what he doesn’t yet know is that he has just lost the credibility of his potential investors. They have each sat in front of too many pitches to remember where companies have not clearly defined their market size or worse still overestimated the size of the market opportunity for their new product, service or business. The young entrepreneur gets his investment but not before the dragons have cut his financial assumptions to shreds and he has surrendered a much greater share of his business for a modest investment.

While our example is fictitious, in reality most established companies struggle to define the market size and potential for their products and services.

In this blog, we will explore the different elements of market size, why it is important to quantify, and how to properly define it for your business.

What is Market Size?

Market size is defined as the total number or value of potential buyers for your product or service. There are many ways that you can define a market but the most typical ways are by geography (eg. Germany), or by by sector (eg. medical devices), or by a combination of these two factors.

Why is it important to define?

Like our Dragon’s Den example, one potential audience for market size are external company investors. Their motivation: what is the scalable opportunity for this business?

In most cases however the more important audience for this intelligence is inside your company:

Sales: To develop a growth plan what is the potential for this growth? How many potential buyers are there for us to target? What share of this market potential could we win versus competition in the marketplace?

Marketing: Is the market we operate in growing, mature or declining in size and based on this information what is our strategy to grow within this?

R&D: Is the potential for our existing products or services limited by the size of the market and do we need to innovate to expand our market potential or enter new markets?

Finance: If we invest in sales, marketing or product development, what is our likely return on investment from this?

So fundamentally, defining the market size and potential for your products and services should be a continuous conversation within a company to protect your market position and foster growth strategies.

Considering undertaking market research read why it is so important here.

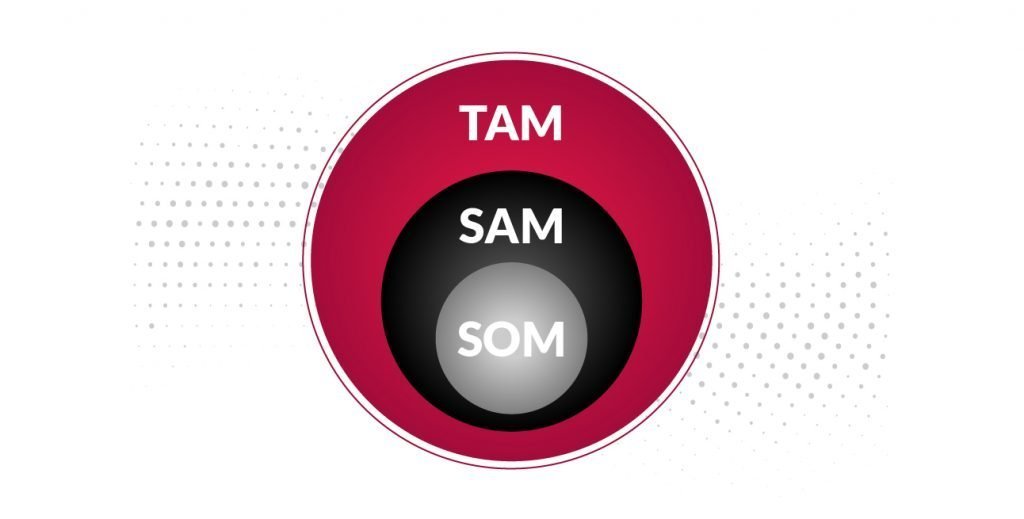

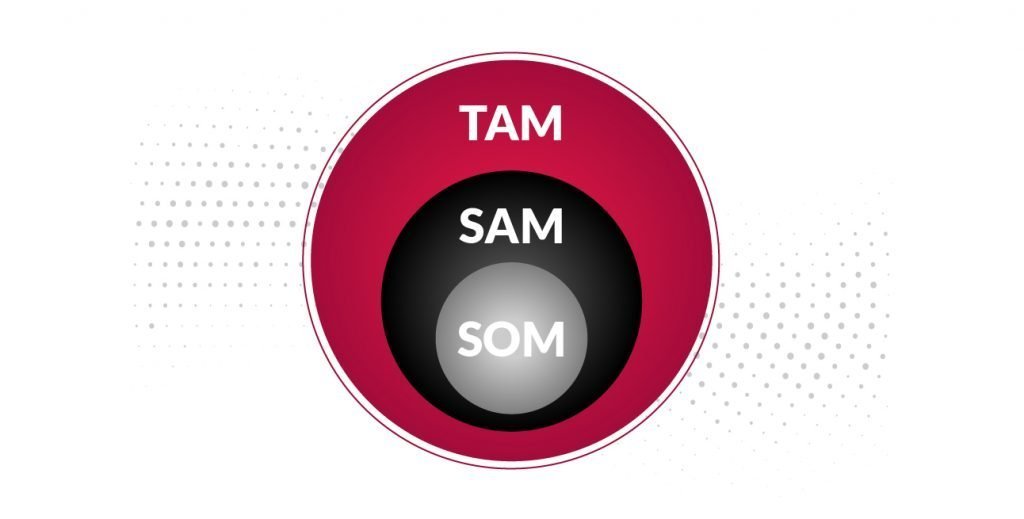

Understanding your TAM, SAM and SOM

These terms are key to defining your market size and potential in a realistic way so lets look at these definitions with an industry example:

Your product: Your company manufacturers temperature sensors and is targeting the German automotive sector.

TAM (Total Available market). This is the total market demand for your product or service. In this case, it is defined as the total demand for all types of temperature sensors by German automobile manufacturers. Good to know, but in reality there are many technology choices when it comes to temperature sensors and you may be unable to provide a technical solution to meet all of these.

SAM (Served Available Market). This is the portion or segment of the total market that you are able to potentially serve with your current technology. Temperature sensing can be addressed through many sensor types including NTC, PTC, RTD, Thermocouples, etc. Our sample company just makes NTCs so they are only able to serve the portion of the market which will use this type technology – ie. their served available market.

SOM (Serviceable Obtainable Market). Okay, you have defined your SAM but in reality you need to consider existing competition, your actual competitiveness and other factors which may be outside of your control. For this reason you may come up with a more conservative estimate of what element of the market you can win (or obtain).

By thinking about your market size along these lines you will not only more realistically define your market but also identify suitable growth strategies for your company.

So how do you find this information?

It is rare that you will be able to quantify market size in exact terms. The best that any company can do is estimate this using validated sources and credible data. Market size can be estimated in two ways: Top-down and Bottom-Up.

Top-Down

We always start with a comprehensive internet search for industry publications, magazine articles, the annual reports of some of the larger industry players, etc. as many of these sources will comment on the market in an informed way. For many markets, independent industry reports may exist which value the overall market size and provide data on key segments and industry trends. These reports are great at providing a birds eye view of an industry and as they are normally compiled by professional research companies and provide a validated and objective source for your business plan. There are a two downsides however: (1) they can be very expensive and prices of $5000 per report would be typical, and (2) they can be too general and provide you with information on the broader market only, your TAM, rather than the specific market you operate in, your SAM. If these top-down searches are unsuccessful for you, or financially prohibitive, then you need to look at option 2: Bottom-Up.

Bottom-Up

A bottom-up approach is one where you undertake your own research to identify specific customers within your target market and build assumptions around this. In the case of our temperature sensor company, this would involve researching a list of the German automotive manufacturers (TAM). It would then involve meeting and speaking with a sample of these companies to understand their temperature applications in more detail and the commercial opportunity for your specific technology from there (SAM). This is a process which takes time as getting in front of target customers is not easy. You could also describe it as a sales led approach but our experience is that it provides very grounded feedback and truer evidence of market potential to inform your overall market assumptions.

You can read more on the difference between a Top-Down Versus a Bottom-Up approach here.

Summary Advice: Focus on your customer

There is always a place for top-down research especially if it provides a birds eye view of your industry and it comes from validated sources. Our experience in working with hundreds of companies over the past 14 years is that the most successful companies are those that place priority on a bottom-up approach. Such companies know exactly who their target customer is (SAM). They can clearly profile them and know that growth will be defined by finding more of these customers and evolving their products and services to meet their needs. In staying close to their customers they understand the trends which will impact on the growth of their market or provide risks to their business. And while many may not even call it “market research”, each day they gain a better understanding of their market from a bottom-up perspective and can accurately say that there are X number of companies that we can serve and know from their sales process what their chances of success will be (SOM). And it is the same approach when they are entering a new market: The priority continues to be on getting face-time with target customers to validate the market opportunity and build their business plan from there.

Whether your company is a start-up or a multinational, this customer-led approach is what we would consider best practice. Some marketing expertise may be needed to point you in the right direction and undoubtedly there is a place for global industry reports, but the biggest skill will lie in your commitment and inquisitiveness to get in front of customers and ask the right questions.

Get in touch with us at [email protected] or call us on +353091739450 if you have an further queries about this blog post.